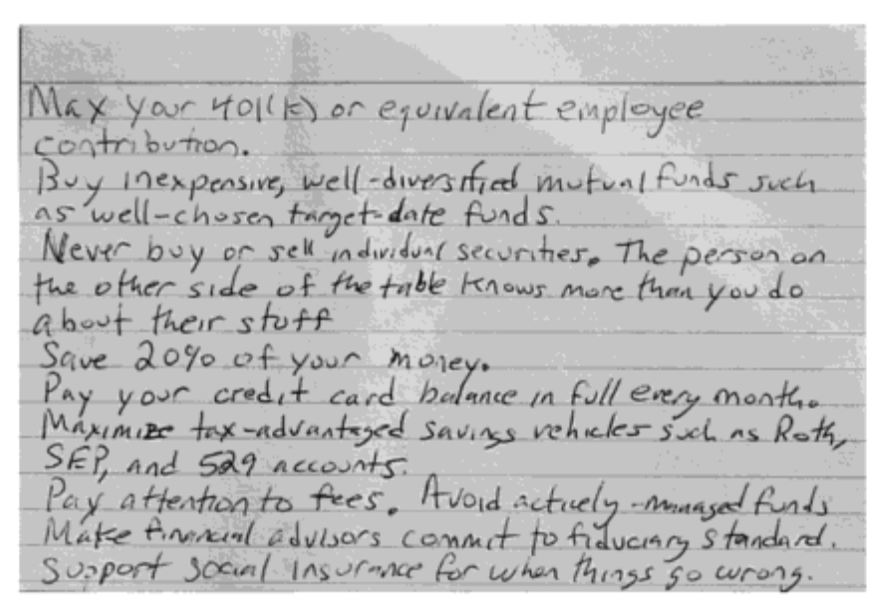

Harold Pollack is a University of Chicago professor famously said: “that the best (financial) advice for most people would fit on an index card.” He and writer Helaine Olen ironically wrote a whole book 1about the expanded topic. I haven’t read it yet. The card that inspired the book is below.

Twitter version: contribute to your 401(k). Limit fees. Invest. Save. Don’t have dumb debt. Live below your means.

What would such an index card healthcare advice look like for a consumer?

This post is not index card length advice and the relatively short length leaves out some important details. This is me, freewriting, mostly fact-checked. This is not how the world should be, but how most consumers face it today. Forget any potential legislative changes for now.

A little background: In the US, healthcare is 18% of the economy and growing 2x faster than GDP. It’s a great country for brain surgery but very pricey for mending a broken bone2. This makes sense when you consider that relative to OECD countries, we have excess administration costs (8% vs. 3%), higher rates of innovation (innovation in healthcare tends to be inflationary), we pay more for drugs, have greater pharmaceutical research, higher wages for healthcare workers (especially doctors), legal layers, more rent-seeking players (brokers, Rx middlemen, insurers), lack of choice of amenities (no choice of economy class hospitals like in Singapore), a relative lack of rationing (we can get appointments sooner), we’re wider (2/3 of Americans are overweight), and because of our relative wealth, we demand more new knees and hips.

That’s a lot that separates us from being an 11% of GDP kind of healthcare country. All those layers, however, create arbitrage that new companies are waking up to through new menus, purchasing frameworks, and greater scrutiny around costs and contracting. Employers, and therefore employees through foregone wages, are the largest purchasers of healthcare in the US.

(Especially) If you’re under 65:

There’s no substitute for being health literate, having a decent diet, regular vigorous exercise, and good social connections. Most of health has nothing to do with the health systems or health interventions but is led by genes, environment, diet, stress, exercise levels, and social support. While skilled surgeons and compassionate nurses work their magic every day, like with money, nobody cares about your health as you do.

If you’re an employee and are offered a menu of plans by your employer, the highest deductible is often the best (due to adverse selection). You can save the difference in premiums in a health savings account (HSA). If you need to roll over an account, Lively HSA is the best, paperless, charges no fees, and has no investment minimums.

For prescription drugs, GoodRx is a valuable browser-based tool that will help compare local prices. The autopilot version of this is Costco or Walmart.

Most care in under 65 is episodic (maternity, accidents, antibiotics).

For price transparency, front door policies are best: avoid hospitals where possible. For-profit hospitals are actually cheaper on average than non-profit ones. Use imaging centers (where MRIs are typically 3-5x cheaper), outpatient medical facilities, and ask for discounts and 2nd opinions. Consider an independent doctor.

Hospital system doctors are tied to a hospital and will refer to high-cost care. Much of the new flashy stuff doesn’t save much and is distracting. Step trackers may lead to weight gain, data mining health records is full of holes, and telemedicine doesn’t replace the ER. I’ve never seen a doctor-finder algorithm that’s worth the hype. If you’re self-employed, research alternative forms of coverage. There are now short-term options, Ministry plans, companies like Sedera health, that all cost much less. Like with all transactions, caveat emptor.

Markets and health evolve and new solutions are sprouting up. The best have index card simplicity.