There’s an employee benefit that ranks higher than flexible work hours, more vacation time, student loan assistance, triple-strained yogurt, organic tofu, or German ping pong tables. It’s outlined in a 20-40 page document, relates to your health and finances, can be useful in pay negotiations, and is the most valued benefit by job seekers.

It’s a company’s healthcare benefits and they’re found in the open enrollment (OE) guide. Its stage time is (usually) November during open enrollment. The meat of the guide outlines your healthcare benefits, copays, and employee premiums. It also includes ancillary benefits of varying worth such as life insurance, dental, vision, pre-paid legal, pet insurance, and often pictures of happy families riding bikes.

Not surprisingly, the majority of companies are slow to make OE guides public. Having plan designs and premium cost sharing would allow you to normalize the dollar value of benefits and give you an edge when negotiating a new job. I’ve been trying to get Google’s. However, you can get a sense of companies benefits by reading and sifting through Glassdoor. Google has food, free onsite clinics, dry cleaning, rich maternity benefits, low employee contributions, generous plans, as well as $1,000 in company money for a Health Savings Account (HSA). You get the picture.

Harvard Business Publishing (HBP), a part of Harvard University, arguably the most storied business franchise in history, is transparent and publishes theirs along with premium cost sharing, leaving it all there for those bored (or interested) enough to read them. Several other employers such as Bank of America, the University of Chicago, and Leidos (a publicly-traded engineering firm) have public OE guides but leave out almost all mention of premium cost sharing.

The HBP open enrollment guide gives outsiders a case study in plan selection and the important contribution nudges Harvard makes. The guide includes a choice of four plans plus employee and employer contributions. It’s still not ideal in brevity but they deserve an A+ for being open and for the level of public detail. It also helps you realize the HDHP is not just for the healthy Millennials.

Let me explain. Harvard Publishing uses contributions and $500 in HSA dollars, an amount that allows virtually all to save the most with the high deductible health plan (HDHP): If you’re healthy, you save on premiums since higher deductible plans are cheaper, and you get $500. If you hit your out-of-pocket max, you break-even. Of course, there is a list of ‘ifs’ on when to be careful:

- If the prescription drug formulary (list of drugs covered) and employee cost share with the high deductible plan differ from other plans offered, and you’re at risk of taking or know you’re taking an expensive drug–in this example, prescription benefits are the same.

- If you seek out-of-network care and are a very high user, <5% of people, you’ll have higher costs–up to $3,000 more.

- If you’re leaving your company in the first quarter of the year and are planning a surgery, don’t choose the HDHP.

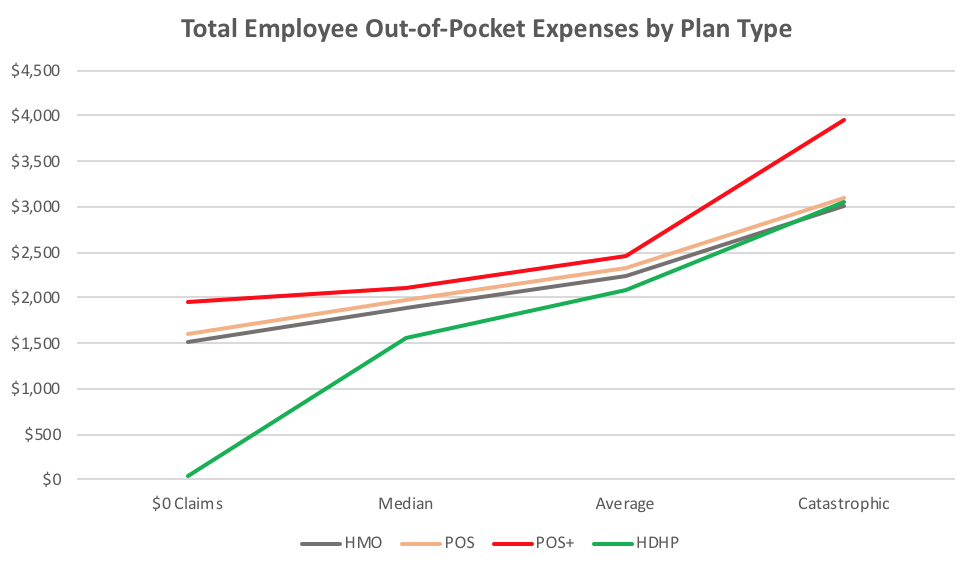

Taking those ‘ifs’ into account, ~90%+ of HBP employees could likely save with a high deductible plan. Below is a visual based on four healthcare utilization scenarios along with the four plans offered by HBP and the employee out-of-pocket (employee premiums + costs at point-of-care – $500 in HSA contribution for those in the HDHP).

You’ll notice the green line, or HDHP, has the lowest costs across healthcare utilization scenarios (claims utilization data are from continuance tables for the commercially insured). If you’re healthy and have no “$0 claims”, you save $1,500 on the premium, money you can save for future healthcare expenses. If you have over $11,500 in medical claims (“Catastrophic”) and hit your out-of-pocket maximum, something only about 10% of people in an employer-sponsored plan would do, you break-even (I’m calling $-38 break-even as you can see with the green line overtaking the HMO plan).

A company’s open enrollment guide won’t change the world, but transparency starts with companies and their benefits. It’s where the critical perception and appreciation of benefit values begin and it’s why healthcare benefits are so important, especially with low unemployment. As with many things at the Cambridge University, Harvard is worth emulating.