Corporate earnings calls are dry but can be entertaining. There are the rare “boring boneheaded questions are not cool” Elon Musk type comments. There was a lively moment yesterday on FedEx’s earnings call when a Deutsche Bank analyst started the Q&A session by asking CEO Fred Smith about “balancing capital investments and returns,” given negative cash flow numbers while reporting 17% adjusted earnings growth. His answer: “the perspective of Wall Street is always give me the money; perspective from inside FedEx is what’s the best thing we can do for the long term.” A fine rebuttal. It’s a capital intensive business and they’ve gained market share for 18 years straight. FedEx has invested a lot in cyber security too. The NotPetya attack of 2016 was so big that “had TNT (its global shipping arm) been a standalone company at that time, it would have been bankrupt.” Wall Street’s metrics and near-term focus are often at odds with companies’.

Cash flow per share matters but so do the near-term realities of the business. Timing is big too. Seeds need to be planted and those focused on guessing next quarter’s earnings per share may not appreciate that. Greenlight Capital’s David Einhorn said “I think one of the inefficiencies in the market is investors are generically too short-term oriented and time arbitrage is one of the best inefficiencies in the market.”

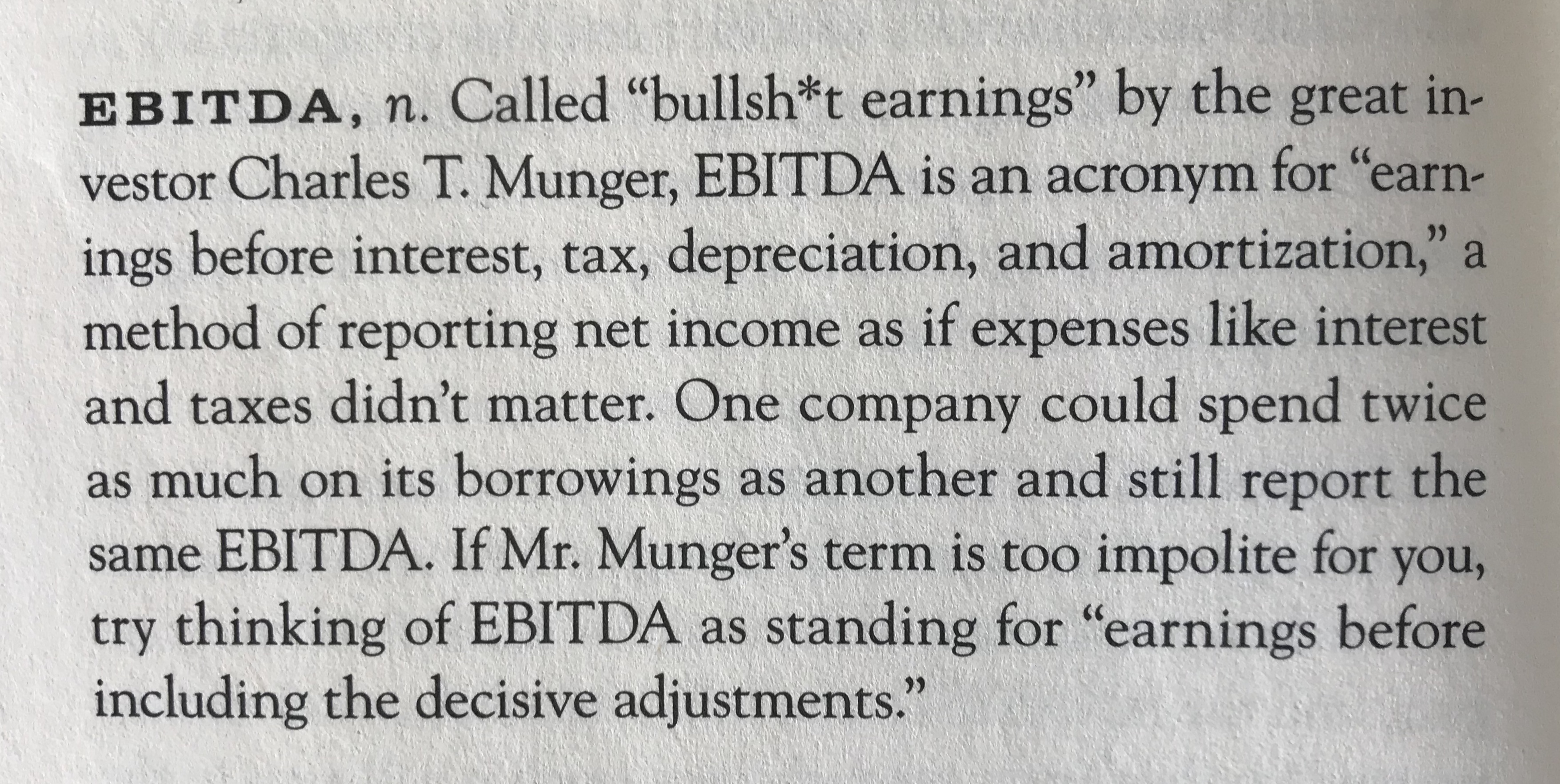

With timing and perspective, there are also abused metrics. EBITDA is one. It is earnings before interest, taxes, depreciation, and amortization. Some adjust it even more, largely to account for employee stock options. An asset is worth all the future cash flows discounted to the present. The bird in hand is worth two in the bush analogy from Aesop as Buffett makes the parallel. A company is not worth the net present value of its adjusted EBITDA. Financial Journalist Jason Zweig in his funny and beautiful book “The Devil’s Financial Dictionary” said this:

One company I follow, one that’s well-run, growing, important to healthcare, and generating lots of cash, uses adjusted EBITDA as one of its core metrics. In an email exchange, the CEO said they use it since 99% of outside shareholders are institutional investors, and that it’s a metric they were use to using to compare growth companies. He conceded, however, that the company would some day likely move to adjusted earnings. One thing I pointed out: the truer value-centric free cash flow per share has increased at a faster rate than adjusted EBITDA, a suspicious metric–the cleaner cash flow version makes them look better.

EBITDA is crap but today I’m a little more tolerant of it.

Photo by Liam Kevan on Unsplash