A 10k means different things to different people. For some, to use what I think is a British term, it’s a footrace. If you’re thinking rings, it’s a measure of the purity of gold. For others, a not-so-breezy 100+ page annual report that’s filed with the SEC by US-listed companies, full of footnotes, official risks, financial statements, a business overview, legal proceedings, and more. It’s not the same as the glossy annual report, which, though it shows numbers, and uniquely and usefully, the letter to shareholders, it looks more like a designer’s canvas. See below.

A 10-K is more the mind and playground of lawyers and accountants. It’s the stuff analysts and finance nerds read on Saturday mornings. CVS’s 2018 filing is here. A sample from one of its pages is here:

CVS is the $190B+ revenue pharmacy, pharmacy benefit manager (PBM), healthcare benefits, healthcare services company, and now owner of Aetna, the $78B company it swallowed in November. If you’ve noticed CVS’s physical presence a little more, it’s because they’ve spent the last 5 years, through new store openings, relocations, or acquisitions, adding 10 new stores per week. The company is a behemoth through its network of 9,900 retail clinics (there are 14,000 McDonald’s in the US), 1,100 walk-in clinics, 2.3M seniors enrolled in Medicare Advantage Plans, 92M plan members and 1.9B prescriptions through pharmacy benefit manager business, 1.3B prescriptions filled at its retail clinics (76% of total CVS store sales come from Rx). It takes some detective work to get beyond the language of formularies, and the smoke of rebates, maximum allowable cost, and average wholesale price. As Al Lewis and Tom Emerick wrote in the excellent book Cracking Health Costs, for pharmacy costs, what matters is the spread, or the revenue per prescription.

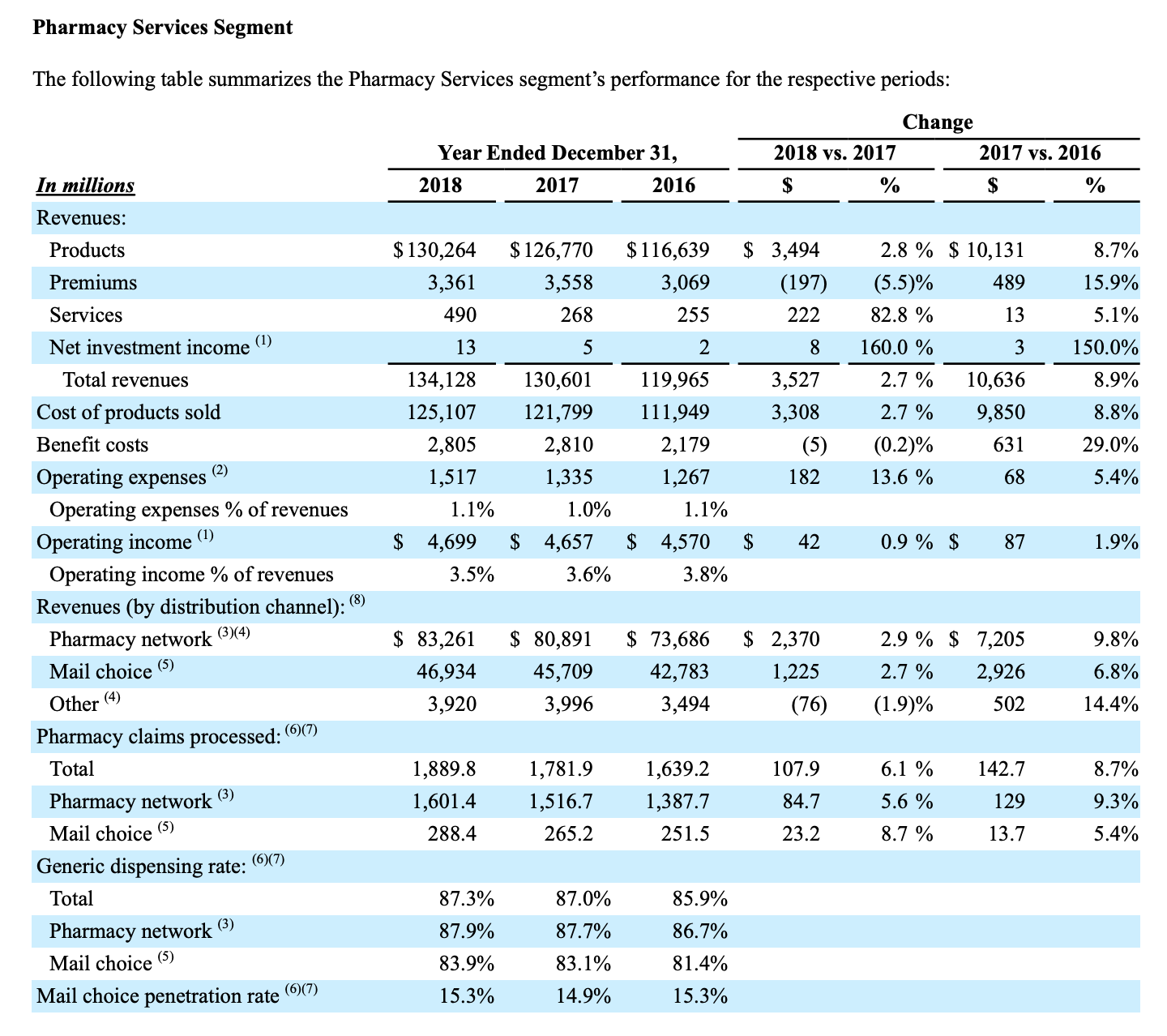

Why is CVS’s stock down 30% relative to the S&P 500 since November? It could be some indigestion from the Aetna acquisition, uncertainty around the next legislative moves in healthcare (health insurers are down double digits), and pressure around pharmacy costs and utilization. To quote the lawyer’s language from the 10-K: “The PBM industry has been experiencing margin pressure as a result of competitive pressures and increased client demands for lower prices, increased revenue sharing, enhanced service offerings and/or higher service levels.” The margins show.

To those who love to hate CVS, a little Schadenfreude from 2018:

- mail-order prescriptions are up 9%, while revenue per prescription was down 2.7%.

- revenue per pharmacy network claim was down 2.7%.

- the generic dispensing rate is 87.3% up slightly from 87%. For the country, this is good; people are opting for cheaper generics.

- and the gross profit per 30-day equivalent prescription was $2.73. That’s after costs, “discounts”, rebates and all that, down 2.2% from 2017.

Lest you feel sorry for CVS and offer to add to the tip jar next time you’re there for a prescription or for their occasional sale on milk (that’s a thing at one near my house), the company earns a healthy return on equity of 12%, has size and scale, but has an enterprise value of 20x free cash flow (11x EBITDA if you prefer that inferior metric). If this is enough to interest you, I suggest you read or skim the 10-K, at least the Management’s Discussion and Analysis section, as well as the CEO’s letter in the annual report. Larry Merlo, the CEO, has a great mustache too.

Photo by Christine Sandu on Unsplash