Baseball cards are part of Americana. The slotted binders, stats, and bike rides to shops evoke nostalgia too.

The investment merit of cards fit is another question. An index of the rarest of cards may have outperformed the S&P 500 by 2.3x over the last 10 years but that’s a small niche with gated access. Though investment returns on cards and collectibles are hard to find details on, they lag bonds, stocks, and real estate.

To sell cards is to accept the current market value. An extra dose of home-centeredness has opened a door to explore the liquidation of boxes of cards that stretch from the 40s to the 90s. My three kids have the green light to sell them on eBay. It’s fun to watch old price stickers lead to visions of fortunes. They decide how to group them for sale and what to charge and how to split the money. After a little searching, current market value estimates are front and center.

Asset prices fit on a scale of what people are willing to pay and the discounted value of future cash flows. A house’s value is largely based on comparable home sales1. There’s an implied rental yield of a home as well. Stock valuations are based on the last known market sale, theoretically reflecting all expected discounted future cash flows. For private equity investments, it’s some multiple of reality. Sports cards have no dividends or future cash flows other than the expectations of what others may pay.

For my kids, fair market value is key, and I trust this is a lesson they won’t forget.

“The fair market value is the price at which the property would change hands between a willing buyer and a willing seller, neither being under any compulsion to buy or to sell and both having reasonable knowledge of relevant facts.” 2

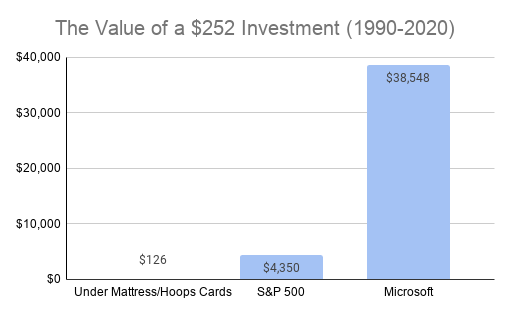

A set of 252 unopened packs of 1989 Hoops basketball cards have matched the return you’d have if you put money under a mattress (bought at $1 each from what I recall and now worth half as much, falling behind inflation). They are now at auction on eBay. It’s sobering to compare that investment to the alternatives of buying the S&P 500 index, or Microsoft.

Like the mattress/card strategy, health insurance value to the consumer has eroded. Premiums are up 100% over ten years, while deductibles have tripled, leaving a greater chunk of costs to employees. Good for shareholders, not for policyholders. An opportunity to improve health savings account (HSA) investments (28M Americans have an HSA, and 1.5M invest a portion of their dollars according to Devenir) provides a hedge against some of the future lumpy healthcare expenditures. Other strategies on where to buy meds and what coverage to choose can save us money.

Cards as an asset class fall short. With the sorting, searching, stats, auctions, and shipping, my kids just want the money. They’re eager to buy stocks: a piece of Disney, Apple, or Tesla.

Disclosures: my personal healthcare coverage is a $5,000 deductible cost-sharing plan (non-ACA compliant). Healthcare investments: long CI, HQY; TDOC (short via long puts). I have a Lively HSA and have invested most of the balance in 5 stocks via a self-directed TD Ameritrade account. Photo by Mick Haupt on Unsplash.

- That works until it doesn’t. See real estate in 2008 in Las Vegas

- From the taxman himself in the US