Kellogg tells you their cereal is natural and has whole grains. There are no broccoli lobbyists or marketers (other than moms). Some good things do need reminders. One trigger for some of my favorite healthcare and financial housekeeping tips starts with a fresh door: a new job.

Switching Jobs

Over a 10 year period, an employee’s biggest medical expense is likely payroll contributions toward premiums (median: $100 per month; $400 for families)1 while median out-of-pocket expenses are $60 per month. Generous firms often charge employees $2,0002 to $8,0003 less per year and offer lower deductibles4. This knowledge means negotiating power.

Try. Insiders are often wrong.

I recently asked someone with a deep background in healthcare what purchasing advice he gives to friends and family.

“I don’t give advice.”

“What in healthcare is likely to change in the next 10 years?” I asked.

“Nothing.”

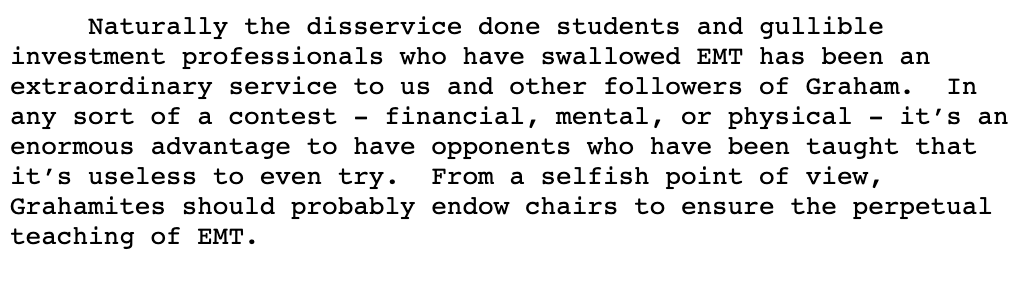

This thinking is like the extreme version of the Efficient Market Theory (EMT), which says that a 20 dollar bill on the sidewalk is either a figment or so elusive that it’s not worth picking up. “Don’t bother to pick stocks” is the implication. In 1988 Warren Buffett said the following:

Telling people not to try is a blessing to those who do. The shortcuts are less crowded. I’ve stopped telling people to try if they don’t want to. We actually need more EMT endowments.

What works?

The most promising solutions ease friction, are simple, and make the purchasers look good. Only fifth-grade math is needed.

Paytient provides zero-interest credit lines to employees for medical, dental, vet care, and more. This eases some of the sting of higher deductibles and allows health savings dollars to snowball over time.

Lively has a fresh health savings account (HSA) experience with the no fees and the best investment choices, either on autopilot, index funds, or through individual stock selection.

Tools and data exist to help value a healthcare benefits package, potentially adding thousands of dollars to a counteroffer for a job. That’s impressive homework.

A new job is a good time to consolidate accounts, consider a rollover, and make information a little more symmetrical. It’s like financial broccoli.

Disclosures: my personal healthcare coverage is a $5,000 deductible cost-sharing plan (non-ACA compliant). Healthcare investments: long CI, HQY; TDOC (short via long puts). I have a Lively HSA and also have an affiliate agreement with them. I also consult for Paytient.co.