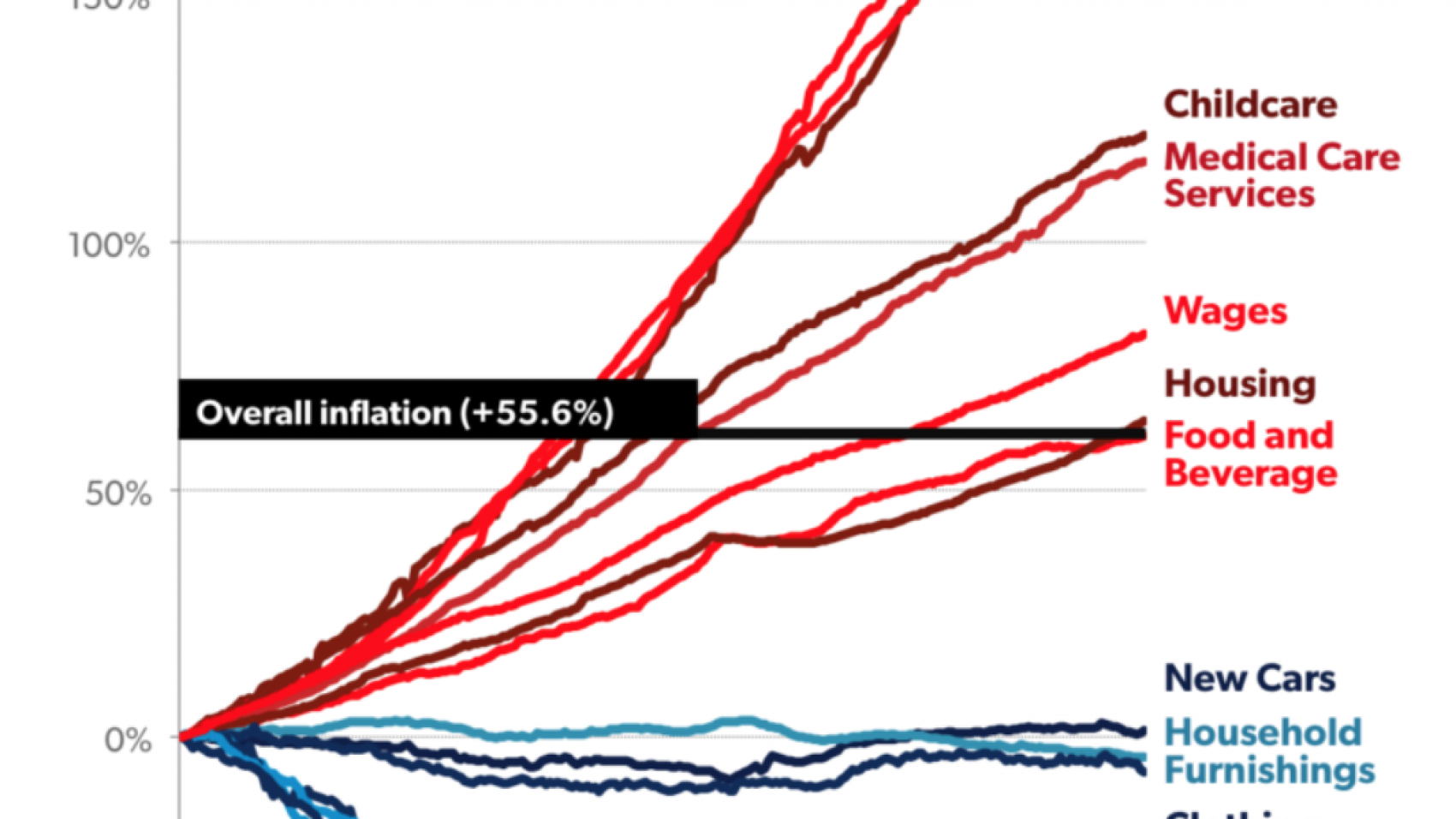

On the deflationary side, we have TVs. One the end, we have hospital costs. A book full of opinions offers causes and solutions to persistent medical inflation of 2-3x CPI. But let’s be practical.

To begin to ponder and plan for inflation is to think about our current and future purchases. Not to the penny but broadly. Where do you spend your money? With housing, likely the largest category, you can hedge future rent increases by buying a home at a fair price and staying 5+ years, with two eyes on the price relative to rent, and one corner of an eye on price vs. replacement costs.

What about the cost of medical care over 10+ years? How can you hedge that?

When young and healthy, you likely think more about your portion of healthcare premiums than the total healthcare costs gobbling up GDP that you read in the news. Yes, premiums reflect expected costs but most, outside maternity, in their 20s-60s will be hospitalized perhaps once per decade, and your chance of having above-average medical claims for 3 yrs in a row is 4-5%. For employer-provided insurance, the top claims are related to maternity, musculoskeletal, or bad luck. Premiums, with adequate coverage, and peace of mind is what matters to employees. Choosing the highest deductible available, especially over a 5-10 year period, gives you the opportunity to save in total costs, often $2,000+ per year.

Witness any healthcare townhalls and the Boomers show up in force. Needs not only change as we age but so does our exposure to out-of-pocket costs. Healthcare inflation, as measured by the consumer price index, or CPI, is 2x higher for the elderly. Even with what Medicare pays (read: what we prepay for in working years), it claims a larger percentage of elderly households’ budgets.

Investing for future healthcare costs in retirement means hedging healthcare costs. Fidelity says ~$150,000 is needed for a single retiree. You can get 2/3 of the way there by starting with $1,000 per year, trending at 3% for 40 years, and with investment returns just 2% above long-term medical cost trend. Do today’s savings, likely destined for future healthcare costs deserve special allocation today? I think so. Many healthcare firms have pricing power and most of healthcare tech is inflationary, adding to units of care or higher costs for patented innovations. Excess healthcare profits go somewhere. They don’t just evaporate. New investment products will capture that.

While health savings accounts (HSAs*) are growing, only 5% of account holders invest their balances, though investor balances account for 20% of HSA assets (or $14B) according to Devenir. I think HSA providers will move to have more future healthcare expenditure bucketed programs.

Our health requires two eyes, two ears, and a good sense of smell. Choose the highest deductible offered (with some caveats) and save and invest the difference in premiums. That benefit compounds over the decades. Do a little research on what your benefits are worth and negotiate around that when switching jobs. Companies will never freely offer this info. Meanwhile, eat smaller portions, walk, jog, row, bike, lift or whatever; those are the biggest hedges against your long-term healthcare expenditures.

*HSAs are tax-advantaged accounts linked to health plans with deductibles of at least $1,350.

Disclosures: currently enrolled in a $5,000 deductible cost-sharing plan. Healthcare investments: long Cigna and HealthEquity; short Livongo and Teladoc. HSA account is with Lively HSA.