Warren Buffett likes food and that stretches beyond burgers and peanut brittle. His second principle listed in the Berkshire Hathaway Owner’s Manual has a food metaphor: “In line with Berkshire’s owner-orientation, most of our directors have a significant portion of their net worth invested in the company. We eat our own cooking.” 99% of his wealth is in Berkshire, and the majority of Charlie’s is as well. Interests have been aligned for over 50 years.

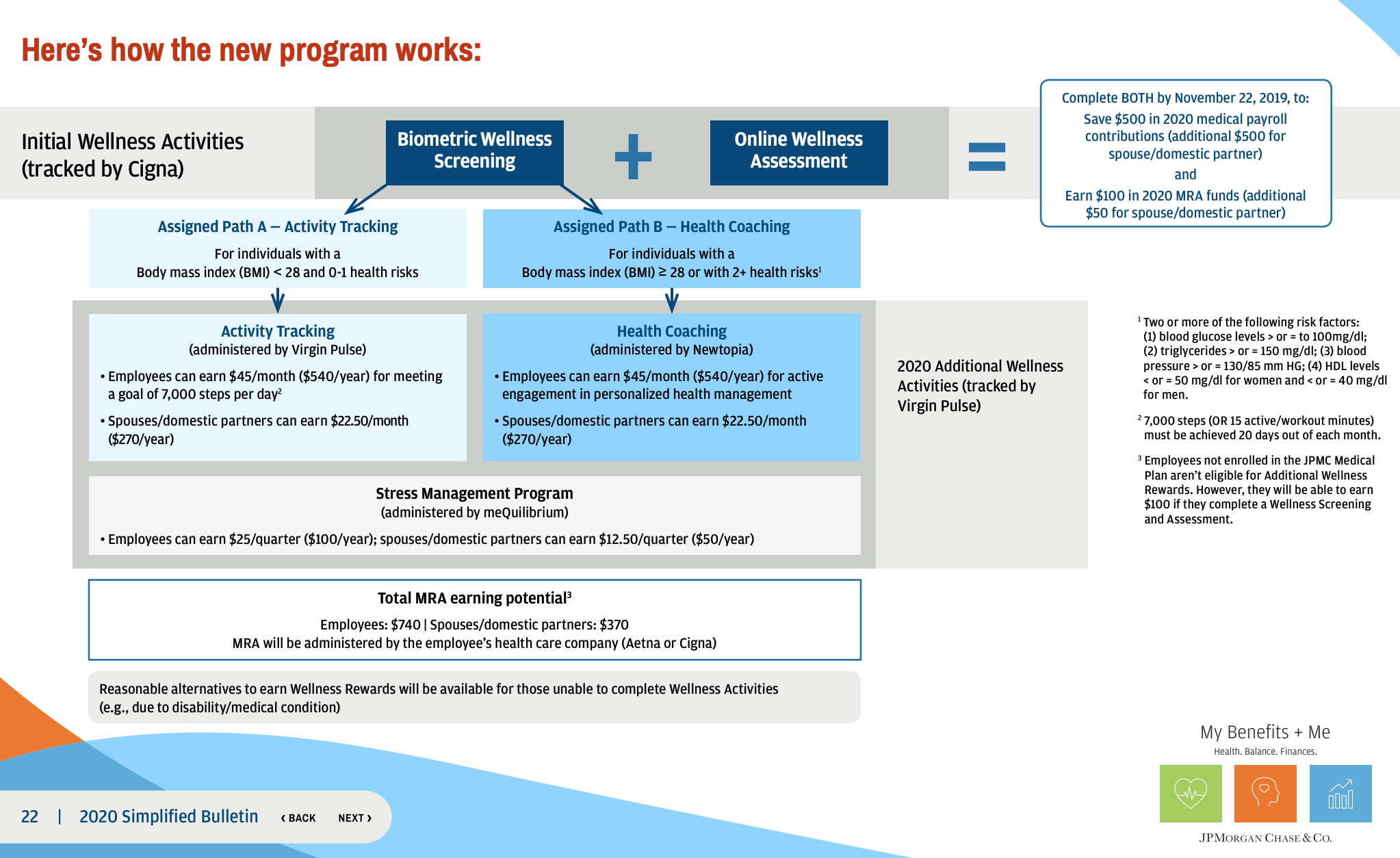

Some companies experiment in the healthcare kitchen. JP Morgan Chase & Co. (JPM) is one of the key players in Haven Healthcare, now two years in the making, whose aim is to create better outcomes and lower costs. It’s trying to move a very large ship. JPM started slowly but is now implementing and running an experiment on 30,000 of its employees in AZ an OH. Beginning this year, claims, experience, and outcomes will then be compared to previous years and to the rest of JPM’s employees. General deductibles are listed as $0 (though there are deductibles: $800 for the emergency room, $1,000 per day for hospitalizations; all the nuances of the plan design changes amount to a $1,000 deductible equivalent). Marketed as wellness-focused, steps are measured, blood is drawn (even when guidelines don’t recommend this every year and it may increase total claims). If you like these kinds of charts, you can follow below to see how the program works. I’m left confused.

Some reading, deciphering, and comparison of the new plans allows for some true comparisons about what this means to employees’ health coverage and pockets. Below is a benefits comparison to other jumbo financial firms in the US. The gray dots are a range of percentiles (10/25/75/90th) for costs to employees. JPM’s new benefits scheme is in blue, the middle of the pack. This includes Plan Option 1, assumes $60,000 in income, and the max medical reimbursement dollars of $740 for following coaching, activity tracking, blood tests, and stress management.

Time will tell what comes out of JPM’s kitchen experiments. Contributions, incentives, and benefit values are nothing spectacular. The clock has started. Healthcare players, employees, and markets are watching.

Disclosures: my personal healthcare coverage is a $5,000 deductible cost-sharing plan (not ACA compliant). Healthcare investments: long CI, HQY; short (via puts): LVGO, TDOC. My HSA account is with Lively.

Photo by Marcin Galusz on Unsplash