Businesses love metrics. One form or novel way (a 5 on the hack prowess scale) is to find the perfect metric that makes the future a little more predictable. The eager student tells the elderly person, “Teach me to be wealthy, only quicker” to paraphrase C.T. Munger. A year after the financial crisis of 2007-2008, Warren Buffett was interviewed and asked what metric he’d look at if he had to reach for one while stranded on an island. He first said freight car loadings, then truck tonnage moved but followed it up with a nicely hedged answer of “I’d want to look at a lot of figures.” As a note: I looked up the data on trains, which is published every Thursday and is available through subscription. I’m working on getting a price for this through the Association of American Railroads (AAR).

Novel metrics are great since they are original and don’t get a lot press, which of course also means they could be a fantasy and have no use. But contrarians are my kind of people. Two metrics I’ve recently started paying more attention to are growth in RV sales and write-offs at hospitals.

RVs are a happy economy, booming business indicator. In 2009, as we first started to get over the recession’s hangover, unit sales for Winnebago (ticker: WGO) were less than half the 2007 and 2008 levels. Fast forward to today and revenue is up 18% year-over-year, with the 26% growth on the towable segment and 2.5% in motorhome segment. Management wisely doesn’t give guidance for the next 2-3 years. The recent rear-view mirror looks good but any change in macroeconomy and WGO will be early to show it. I have their next quarterly earnings call on my calendar.

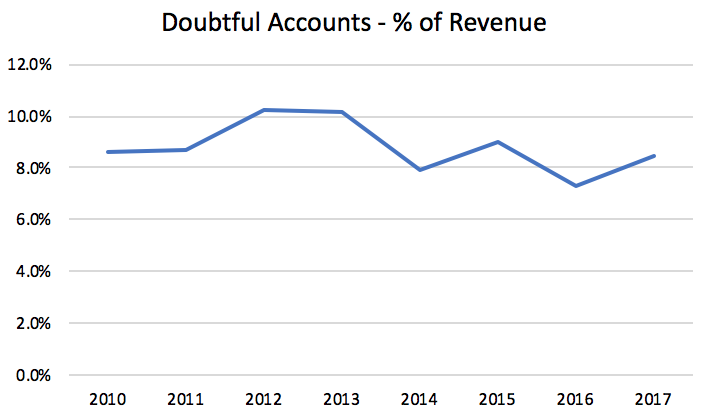

On the other end of the needs-wants scale is healthcare. HCA Healthcare Inc. (HCA) is the largest publicly traded hospital in the US, with 179 locations, and reports many interesting stats within their SEC filings. Doubtful accounts, for accounting geeks, include write-offs, or money a company doesn’t expect to collect. This account is “based upon management’s assessment of historical write-offs and expected net collections, business and economic conditions, trends in federal and state governmental and private employer health care coverage, the rate of growth in uninsured patient admissions and other collection indicators.” Since 2010 the allowance for doubtful accounts bucket has averaged just under 9% of sales with the most recent calendar year below that. The good news, patients are paying their bills at a slightly higher rate than the past.

There are deeper things behind these numbers (what does this mean about Obamacare? What other details are there?) but I will keep that a mystery. RV sales and write-offs are two metrics I follow. Just don’t tell too many people about them.

Photo by Steve Halama on Unsplash