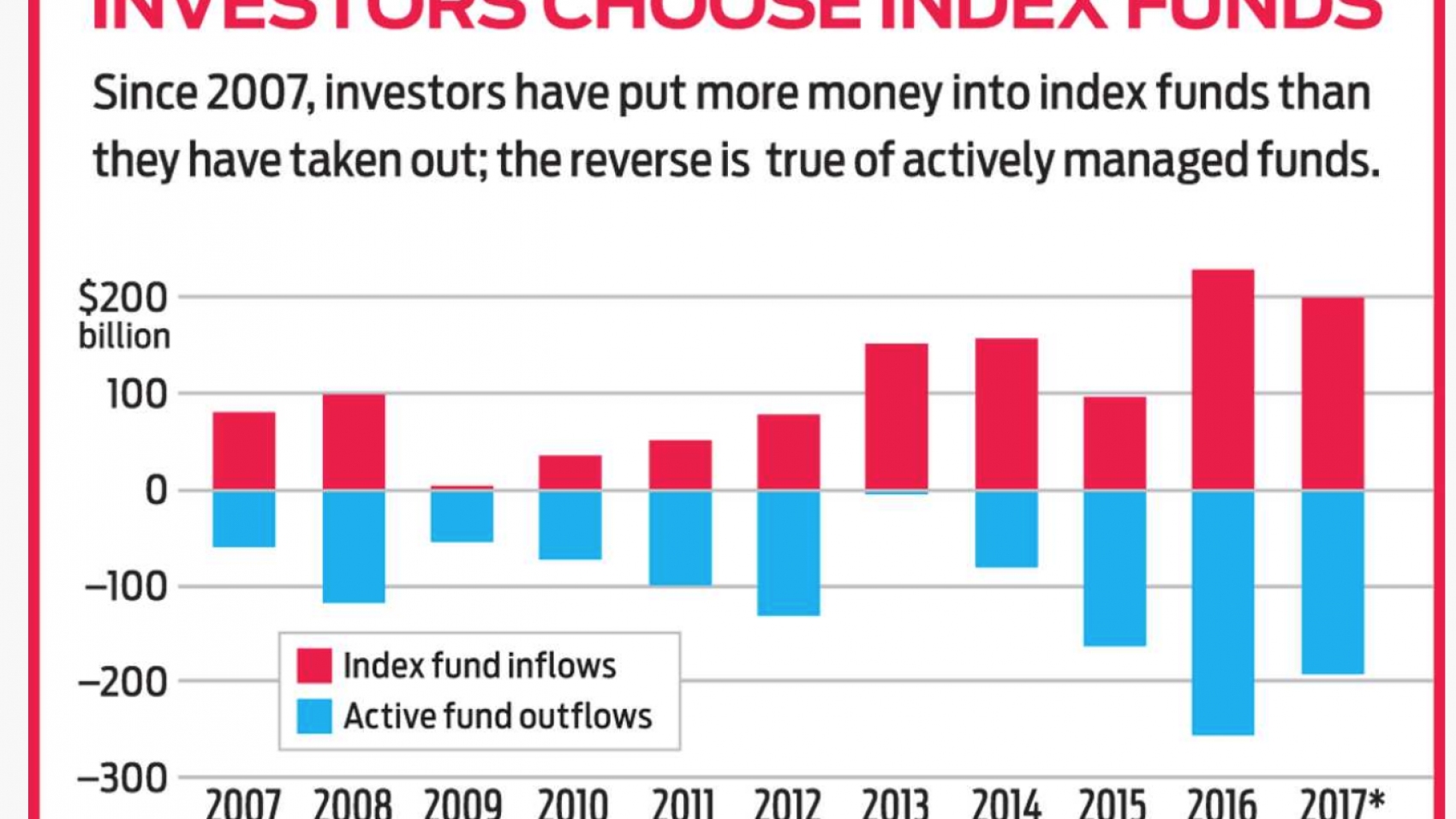

Michael Burry, investor and mortgage crash money maker*, caused a stir in September when he called index funds a bubble, akin to subprime mortgages. Some High Priests of finance and fans of passive approaches lashed out on social media. Indexing is popular. Even Warren Buffett, a lifelong non-indexer, recommends index funds for 90% of his estate once he dies. Burry's unpopular view fits in the category of the Peter Thiel type question: "What important truth do very few people agree with you on? ...

Metrics Matter

In the misty land of adjusted and "community adjusted EBITDA" (thanks to The We Company for backing out the “building- and community-level operating expenses,”) we are reminded that to embellish is natural. We sometimes hide our worst selves and fill our dating profiles with dogs, filters, and a professed love of poetry. Corporate structures can be "simplified" yet impossible to understand. Exhibit A: The We Company. Some die hard. EBITDA was once a metric for cable companies (due to capital ...

Amazon’s Health Benefits

Last year I posted a question on Quora asking what healthcare benefits and cost sharing were like at Google. A few answers of the "it's private" or "No, I can't say" variety soon surfaced. They have sense been oddly scrubbed from the site. Why the secrecy? Rich benefits are a given at Google. Time spent swerving through traffic to drop off dry cleaning, leaving work for lunch, or stressing about a $3,000 deductible cut into productivity. Amazon has rich health benefits and is open and post ...

Open Enrollment Tips

It's the time of year for leaves, baseball, and 30-page open enrollment guides*. If you're a prospective employee, "we offer benefits" doesn't have the precision on the scale of value as does a first class flights to Europe. "We offer a free first class direct flight to London. Travel dates and times are flexible. Towels and champagne." Some could be peddling the 5-day steamship product as if in the same class. For 95% of people, what matters is the dollar value of healthcare benefits. How ...

In Praise of Markets

Charles Schwab is an investment hero of mine. In 1975, when commissions were deregulated, he pounced at the opportunity to launch a discount brokerage. Discounts are now no longer enough. The line in the chart below extends to zero. This week Schwab announced $0 trading fees. How can they do it? Explicit trading fees are only 7% of Schwab's revenue and the move will surely attract more accounts. The firm followed the lead of the now (I have a hunch) deeply troubled Robinhood, a zero dollar Mille ...