- Grant led a fascinating life. Poverty, alcoholism, failure after failure until he thrived as a Civil War general and eventually became president, the first president to do a global tour after. In his old age, he sat down, dying of throat cancer, and wrote his memoirs, desperate to save his family from penury. It worked.

- single coverage PPO vs. HMO in 2020 Kaiser Employer Survey

- I had a partial parotidectomy at age 27 (in 2008) and my employer via self-funded insurance, paid $25,000--my bill was $5. Those were the days.

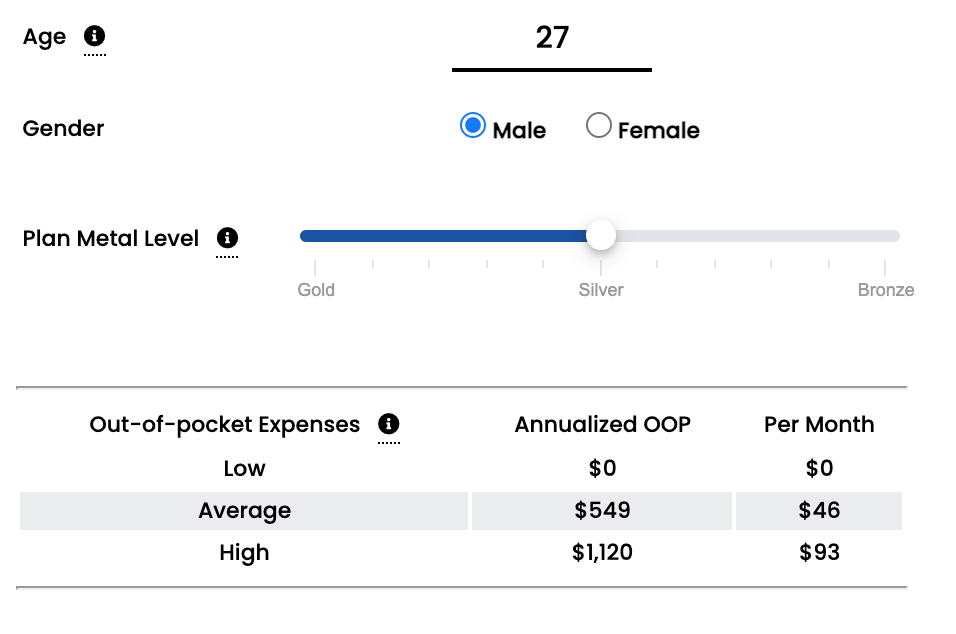

- $2,000 deductible, $5,500 out-of-pocket max

- average comes with all the caveats of averages; high is the modeled number based on the 80th percent confidence interval.