Alchemy is for more than quacks. Even Isaac Newton dabbled in it. But it means more than turning lead into gold1. Rory Sutherland wrote a great book of the same name on a type of alchemy–how marketing can create magic. 1+1 can equal 3. The marketing alchemist is unlike a physicist or economist; small changes can lead to big results.

In health insurance there’s a way to create alchemy.

The health savings account (HSA) is a bit of legislation that passed in 2003 and became law in 2004 that allows you the best of both worlds of tax sheltering and the slickest retirement investment product2. The account is portable so it stays with your when you leave a job. It’s shielded from tax on contributions, investment growth, and when you take money out to pay for healthcare now or for your creaky knee at 65. Given the $150,000 price tag that Fidelity estimates a senior will spend in retirement on out-of-pocket health costs, we all need that.

However, the typical behaviour doesn’t say health savings but health spending. Yet close to 95% of the 31m folks who have an HSA don’t invest any of the balance. Balances are spent or sit dormant, earning a negative return after inflation, leakage that amounts to billions of dollars lost each year.

HSA alchemy is low due to information asymmetry3, inertia (it’s easy to stay on auto-pilot), and lack of investing choices (HSA companies make the most money when you park it in cash and don’t have much of an incentive to promote the most rational behavior).

Part of effecting changes is visualization. We visualize our future selves, fit, happy, rich in whatever way you define it, often through a distorted lens or in a way that says too much work. I’ll pass.

Nuggets of savings and investing add up. Alchemy builds then snowballs. Take the case of Zach Friedman.

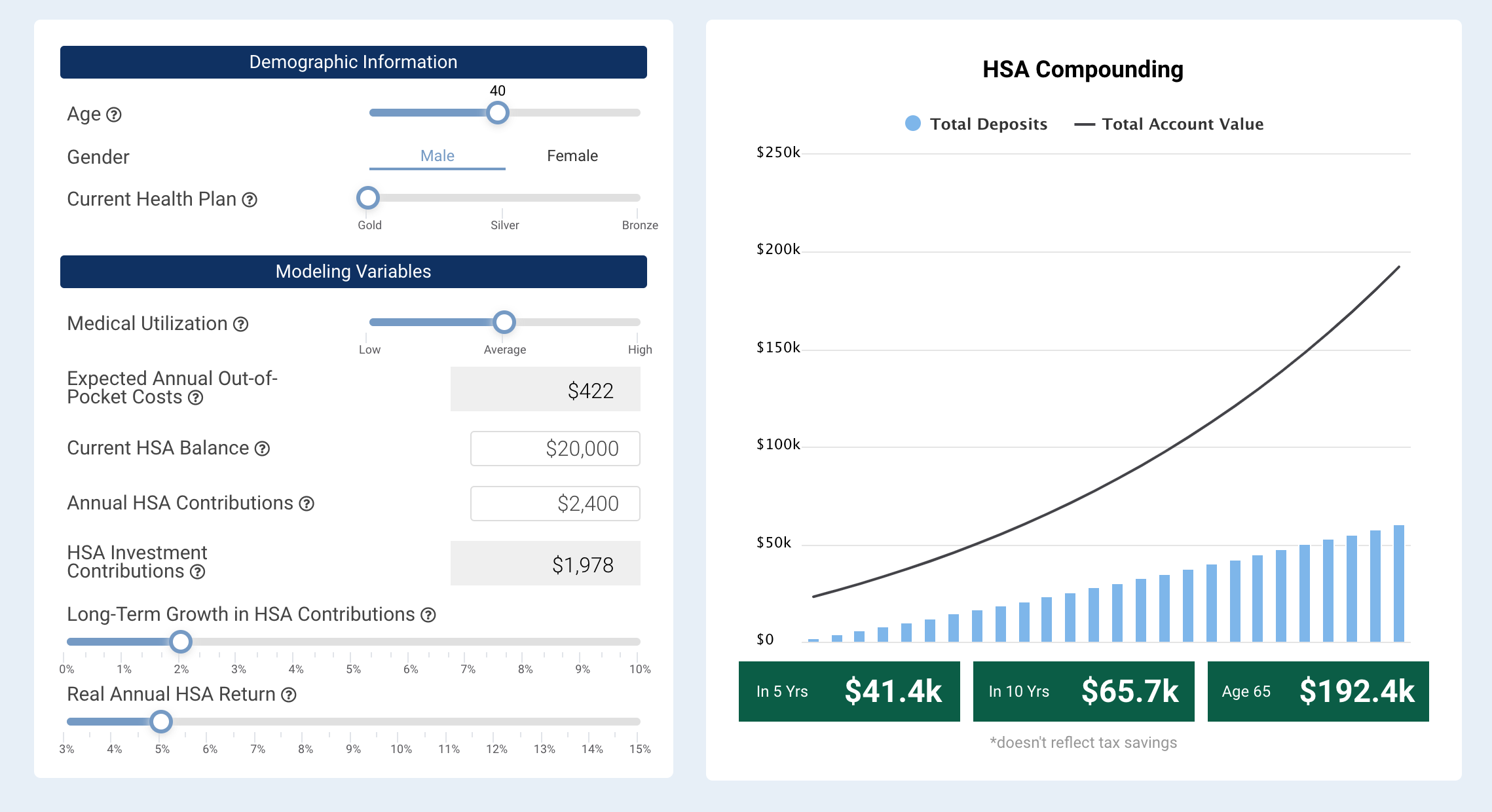

Zach, age 40 is enrolled in a typical healthcare plan with a $1,500 deductible.

– His likely annual out-of-pocket costs are $200 to $800, approximately $400 on average based on his age, gender, and plan selection.

– Current HSA balance of $20,000 sits idle in cash, earning a negative real return.

– With $200/month in HSA contributions, and a 5% real return on his invested balance, he could have $192,000 dollars by the time he is eligible for Medicare. More than enough to offset premiums and copays. His alchemy journey of savings from a high deductible plan, invested with an adequate return, is visualized below.

A path forward connects health and wealth in the big dollar decisions, in the coverage you choose, in understanding how modest out-of-pocket costs are for most, and in providing piece of mind. We have tools to know how much your coverage is worth if you’re employed, to model your costs, and to more rationally invest your HSA balance. Rainy days will come. A little financial alchemy helps.

—

Disclosures: my personal healthcare coverage is a $5,000 deductible cost-sharing plan (non-ACA). Healthcare investments: Covetrus, Cigna, HealthEquity. This article first appeared on in a blog post at diamondlakecapital.com

Photo by Artem Maltsev on Unsplash

- one definition is to transform something in a mysterious way

- the IRS allows contributions of $3,600/year if you’re under 55 and $4,600 if over. To qualify for an HSA you have to have a deductible of at least $1,400; without the HSA channel, you’d only be able to deductible medical expenses after reaching 7.5% of your adjusted gross income–a high bar for the great majority of people

- including employers who provide insurance know more than us and control the cards