The proverbial healthcare industry graveyards and nursing homes are full of companies with good intentions and lots of data. Promises to track our steps and make us healthy have done little. Predictive models tell us that we’re 10% more likely to have an adverse healthcare outcome in 5 years. Yawn. Healthcare exchanges and defined contributions were supposed to unleash choice, consumerism–as were high deductibles. Stale broker relationships mean business as usual.

I’ve written how The Cheesecake Factory (CAKE) discusses healthcare costs in virtually every earnings call. CAKE is an outlier, at least in publicly discussing healthcare costs. The reason behind the nations C-suites’ short attention span on healthcare? Their attention is focused on building new plants in Poland, potential acquisitions, or when to buy back shares. That may change, especially for companies with lower margins and low growth.

Solutions to help companies save on employee healthcare do exist. Direct contracting, bundled services, elimination of the wrong types of wellness programs and the costly incentives, centers of excellence for surgeries (often not necessary and avoided) at lower cost and higher quality facilities, new compensation arrangements for brokers, and more. These can lead to 15%+ savings in healthcare dollars.

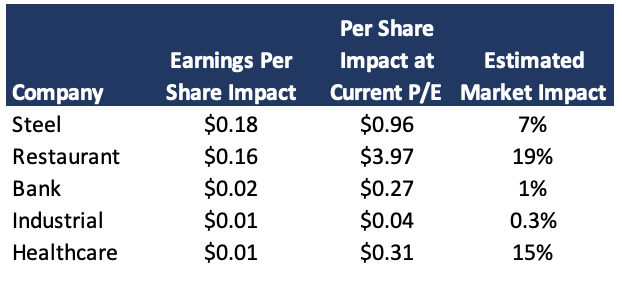

What would 15% savings for employer healthcare be worth to a stock? I looked at 5 micro-cap public companies, those with market values below $300 million. This includes a specialty steel company, a restaurant, a bank, an industrial company, and a healthcare facility company, all selected at random.

I took average industry premiums, take-up rates, adjusted for estimates of additional covered lives, netted out 20% employee contributions, estimating the companies employee healthcare bills, and how much 15% savings to healthcare is relative to earnings per share (EPS), and, at current price-to-earnings (P/E) ratios, what that could do to a stock’s price.

The impact is modest for two of the five companies; it also assumes the 15% gains occur in year 1, but for the restaurant, it’s an estimated 19% gain in market value. Companies with greater stock market values per employee, higher net income margins and revenue per employee, are the least sensitive to savings, at least from the narrow perspective of this analysis. But, if the savings are sustainable, not one-off, and they result in happier, more productive employees, healthcare savings should lead to higher stock prices. Clearly, an N of 5 is limited, but this curiosity of mine will expand this analysis in the future. For the right companies, in many industries, with a strong enough itch, and with an appetite for change, the savings, the impact on the lives of employees, and the share price jump, could be even larger.