Warren Buffett likes food and that stretches beyond burgers and peanut brittle. His second principle listed in the Berkshire Hathaway Owner's Manual has a food metaphor: "In line with Berkshire’s owner-orientation, most of our directors have a significant portion of their net worth invested in the company. We eat our own cooking." 99% of his wealth is in Berkshire, and the majority of Charlie's is as well. Interests have been aligned for over 50 years. Some companies experiment in the healthcare ...

Hedging Healthcare Costs As We Age

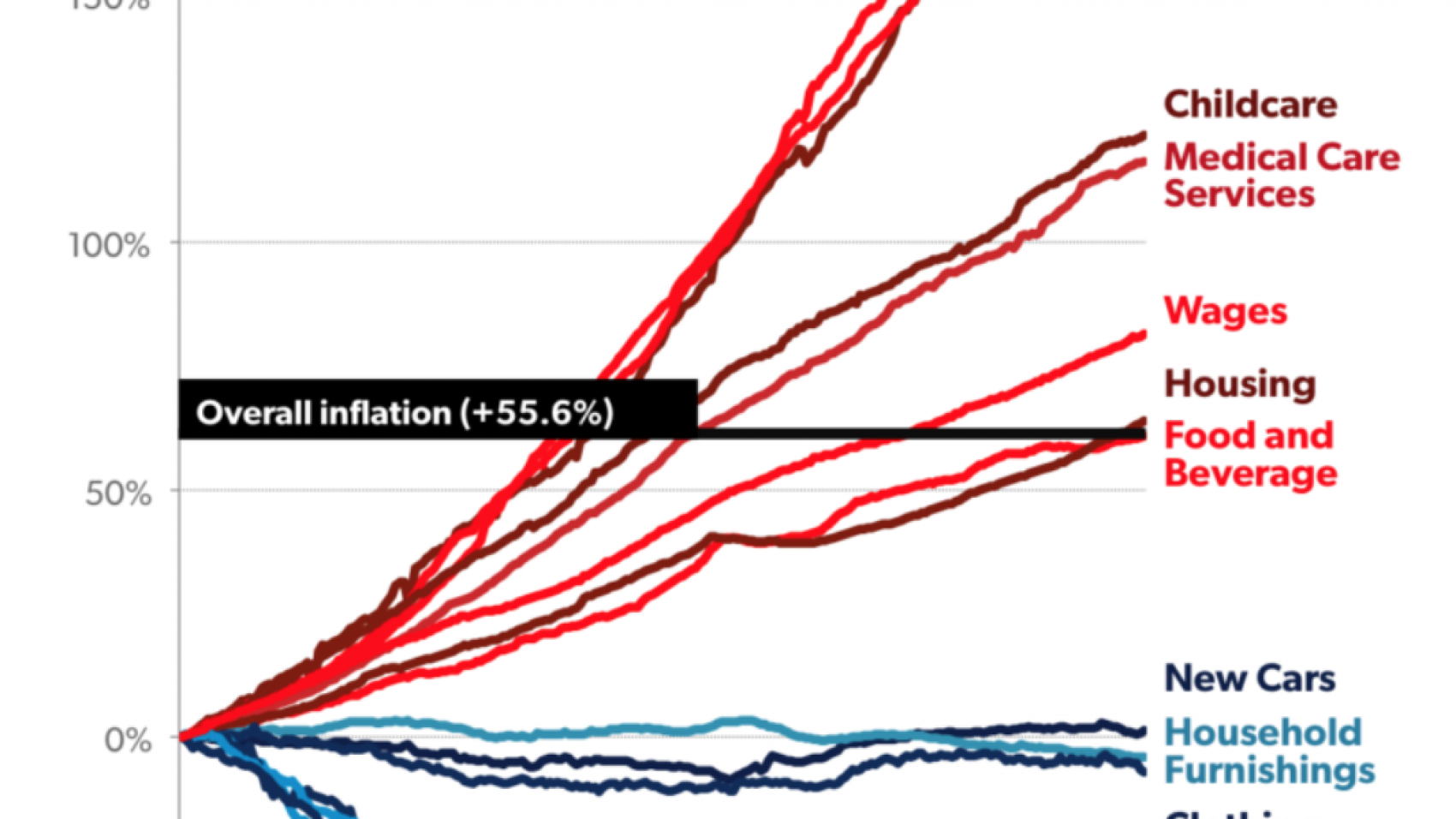

On the deflationary side, we have TVs. One the end, we have hospital costs. A book full of opinions offers causes and solutions to persistent medical inflation of 2-3x CPI. But let's be practical. To begin to ponder and plan for inflation is to think about our current and future purchases. Not to the penny but broadly. Where do you spend your money? With housing, likely the largest category, you can hedge future rent increases by buying a home at a fair price and staying 5+ years, with two eyes ...

Why Some Companies Care More About Healthcare Costs

How much do healthcare costs matter to companies' earnings? Relative to earnings they're larger than many think. 24%. That's the median estimated healthcare costs as a percentage of earnings for the S&P 1000 (the lesser-known index sibling of the S&P 500). I ran an analysis of data from S&P 1000 firms and filtered for those with at last 50 employees and positive earnings. I layered on unique data that includes the average healthcare costs per employee by industry*. This group of 8 ...

Time Arbitrage

One enduring feature of both investing and health is time arbitrage. This creates a gap where price and value diverge. David Einhorn of Greenlight Capital is one of many hedge fund managers to speak of time arbitrage. "I think one of the inefficiencies in the market is investors are generically too short-term oriented and time arbitrage is one of the best inefficiencies in the market." Like a molar, long and hidden, a firm's value is deeply rooted in future profits. Rarely does missing a quarter ...

$300 Questions

There are things you Google: the population of Dubai, the weather, or quotes on insurance*. There are deeper inquiries: what's a firm's adjusted return on equity over time, management's scorecard from share-buyback timing, what a hospital's collections have been over time, the ROI of telemedicine, a hidden fact or tips on a contact for an academic paper on Wellness. There are likely more than a dozen times per year you'd pay $300+ for info like that. These are $300 questions and have inspired m ...